With Yield Farming, Liquidity Mining, and Games, DeFi Truly Puts Your Tokens to Work

Before DeFi (Decentralized Finance), there were only two ways to get more value from your tokens: trade them or hold them. DeFi change that, allowing you to earn interest on your tokens.

You only need a crypto wallet and some tokens to get a seat at the table with DeFi. And once you’re in there are countless ways in which you can start playing with your money.

In this article, I’m going to explain the ways in which you can earn more tokens and recommend a list of handpicked platforms that you can get started with right away!

The whole idea of DeFi is that you can borrow tokens, place them into a pool, even gamble without even providing your name.

While most traditional online platforms require you to provide a complete set of personal information before even being allowed to access their services, DeFi keeps the decentralized promise of keeping software available to anyone, anywhere in the world.

Not to speak that most decentralized services are much more profitable than the traditional ones. If a bank would offer you 1-2% annual interest on your deposit, in DeFi you can earn up to 100x more.

Yield Farming

Yield farming is the process in which you are putting your tokens to work to generate returns. It’s not enough to deposit your tokens in one platform and leave them there.

Being a ‘yield farmer’ means that you are looking for the best strategy to maximize your earnings from your initial funds. Such a strategy requires you to adjust your position from week to week, finding the pool that is offering the best annual returns (APY) at the given time.

Usually, the percentage of returns is directly proportional to the risk of the pool. However, like with any other investment your strategy needs to be crafted around handling the risks.

Liquidity Mining

Liquidity mining is a result of yield farming. The process involves getting tokens as a bonus besides the usual returns.

Imagine that yield farming is the reward you are getting from providing your service (lending your tokens for a period of time) and the newly generated tokens are the result of your mining (participation on the platform)

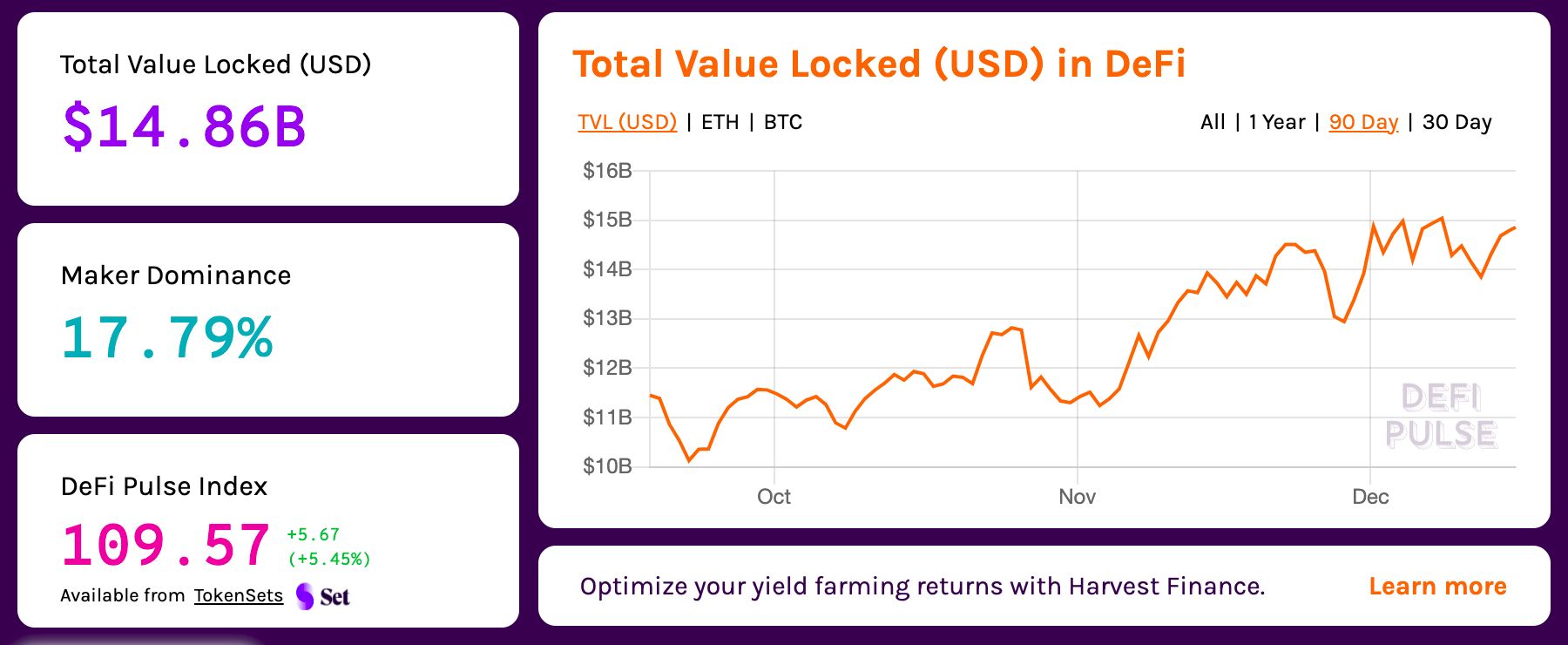

Source: defipulse.com

These newly generated tokens are usually native tokens of the DeFi platform you are using and it can be the governance token of that platform.

Platforms are trying to stimulate users to use their services and, as a token of appreciation, they are giving you a seat at the table. Each governance token counts up as a vote for deciding the future of the platform.

Of course, most tokens hold value in themselves and they can be sold on the open market at any given time. Your decision is always yours.

Where can you become a yield farmer/liquidity miner?

Golden Pyrex DeFi platform is an ecosystem of decentralized solutions such as a token exchange and a gaming and entertainment platform. The project will integrate GDEX, G-SWAP, and GameHouse as the main components of a full-fledged closed-loop ecosystem where users can earn GPYX, the platform’s native token as a reward for their participation in any of the available activities.

The platform is more than a profit-generating space, it aims to offer quality services with customer convenience in mind.

Imagine an online place where you can trade, play, and participate in the DeFi space; all in one place. Not only that it will attract token holders, but, in the future, the team has plans to allow fiat payments.

“To begin with, we are indebted to Kazakhstan Government and Astana International Financial Centre both of which have been taking smart steps to support entrepreneurs in Blockchain and decentralized finance area.

It’s quite evident in the enabling environment they have provided to Bitcoin miners. Kazakhstan ranks number 4 in terms of Bitcoin mining contributing largely to Bitcoin network’s hash rate.” as stated by Ilyas Sadvakassov, CEO & Founder of GPYX

Beyond the DeFi advantages, Golden Pyrex is developing a fair gaming platform where the transparency of blockchain allows players to track the distribution of bets and prizes, eliminating the possibility of cheating altogether.

GPYX token will have roles in farming in yield pools, staking, earning commission from the GameHouse games, payment for tickets, listing on the platform, the native payment method on GoldenBay, and used for the ecosystem’s governance.

Uniswap is a token exchange platform. The main purpose of the app is to trade tokens easily without an order book or giving up control of your funds. You can choose to use it as a casual player or you can participate as a liquidity provider.

It’s one of the first DeFi platforms, being created in 2018 with technology inspired by the Ethereum co-founder, Vitalik Buterin. You can see Uniswap as the first of its kind, even if other new, improved projects have been launched since 2018.

Even if the project is around for more than two years, it got into people’s attention only this year when it announced the distribution of 60% of its genesis tokens to the early users of the platform.

The native token of the protocol is UNI and 1 billion of these tokens were minted when the project was started.

Because it is a governance token so the token holders are going to be part of the decision process behind the platform, the team decided to bootstrap its distribution by giving each address that traded on the app 400 UNI tokens. It was a great payday for anyone who supported the project but unless you were part of those early users that opportunity is already gone.

Curve Finance is a liquidity aggregator that gives its users the chance to go beyond the casual user role and become a liquidity provider.

Curve wasn’t decentralized at launch but it recently made its transition into a decentralized protocol with the addition of its governance token. Being introduced at the beginning of 2020, with almost one year into the DeFi race, it became popular as a platform to earn returns on your tokens.

Not all tokens but stablecoins because Curve is “an exchange expressly designed for stablecoins and bitcoin tokens on Ethereum.”

This means that the platform’s main focus is not supporting as many possible tokens or expanding as an ecosystem but rather become a niched platform that offers some selected tokens like USDT or DAI (stablecoins) or Ethereum-based Bitcoin tokens like renBTC or wBTC.

When its governance token was launched this year in August, the team decided to distribute 5% of the circulating supply to past liquidity providers. Similar to other protocols they wanted to reward their early users who supported the platform in the beginning.

Today, Curve continues to be a great place to earn interest on your tokens even if it is not as lucrative as it was at the beginning of the year.

We might see more yield farming applications in 2021, but, given the history of DeFi projects, the best thing you can do is to join a platform early on. There is a patter that early adopters earned good returns on their investment.

Anyway, rewards don’t come if you are not actively using the platform. If you are a trader, using an exchange on a daily basis is not a problem, but if you are a more casual cryptocurrency enthusiast, you might want to look into the new platforms introducing gaming and entertainment platforms whose participation is bringing you the same benefits as today’s exchanges.

Tags

Create your free account to unlock your custom reading experience.